If a contractor wants to grow their business and increase profit, they will likely require some form of financing to help stabilize their cash flow. Lines of credit are a common choice among the many different financing options for contractors and it’s critical to understand how they work, as well as the pros and cons..

At a high-level, contractor lines of credit should be viewed as a lifeline and not something you want to max out. And as a general rule of thumb, it’s best to safeguard your line of credit and keep it as a buffer for unexpected or emergency expenses, and it’s best to avoid carrying a large balance on it.

Table of Contents

What Is A Contractor Line Of Credit?

A line of credit is a predetermined amount of capital that can be drawn on, which is issued to a contractor by a lender. Unlike a typical loan, a line of credit is not heavily monitored by the bank, meaning contractors have greater flexibility in what purchases they can use it for, similar to a contractor credit card. Additionally, there will likely be a comprehensive application process contractors must fill out, and they must meet certain requirements to get approved.

Some benefits of contractor lines of credit include:

-

- Flexibility – Contractors can utilize these funds whenever and however they’d like, assuming the account is up to date and credit is still available.

- Interest-Only Payments – Contractors will be required to pay interest-only payments on the outstanding balance. These loans are usually not amortized, meaning the principal balance will not be paid down over the life of the loan with a set payment schedule.

- No Prepayment Penalties – At any point you have the cash available to do so, you can pay down your line of credit to $0, with no penalties – unlike other types of loans.

Contractor-Specific Risks With Lines of Credit

Potential Immediate Reduction of Credit Limit

Lines of credit typically offer higher credit limits compared to a standard contractor credit card. This may seem ideal for contractors who spend thousands per week on materials or labor. However, large expenses, higher credit limits and minimal restrictions from the bank are a tempting combination that put contractors at greater risk of maxing out their limit. They’re also vulnerable to missing payments during periods of poor cash flow. Missing a payment could result in a drastic decrease in their limit at any time. In many cases, the cut in your credit limit goes to your current balance, leaving no room for additional purchases. If a bank loses trust in a contractor, it can be very difficult to raise their credit limit in the future.

Blanket Lien on Business

In addition, it’s fairly standard for banks to put a blanket lien on a construction business when issuing a line of credit to a contractor. In the event of non-payment, the bank reserves the right to seize all assets being used as collateral. This means that poor payments on your line of credit could put your entire business at risk. Unlike other financing options (such as project-based financing), lines of credit are not relationship-based. Financial institutions have to assess their borrowers with cold objectivity, strictly looking at factors like on-time payments. In other words, don’t expect your “friendly neighborhood banker” to hear you out when you miss a payment.

What are the Different Types of Lines of Credit for Contractors?

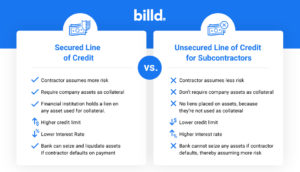

Understanding the differences between lines of credit can help you negotiate what you put up for collateral and who is responsible should you ever default. There are two types of lines of credit, secured and unsecured, which differ in who will assume the most risk.

Secured Lines of Credit

A secured line of credit uses a company’s assets as collateral to ensure repayment. In secured agreements, the financial institution will hold a lien on any asset the contractor puts up for collateral. If the contractor defaults on a payment, the bank can then seize and liquidate the value of the asset.

Typically, because the financial institution has some form of guarantee, the borrowing limit is higher and the interest rate is lower than unsecured lines of credit. It is critical to note that in a secure line of credit, the contractor assumes some risk if they do not pay back their loan.

Unsecured Lines of Credit

Unlike secure agreements, unsecured lines of credit do not require the contractor to put up an asset as collateral. Instead, the financial institution offers a lower credit limit with a higher interest rate. This gives the bank an opportunity to earn extra money, but leaves them more vulnerable if a contractor defaults on their payments.

What are the Requirements for a Contractor Line of Credit?

Lenders will only approve lines of credit if the contractor meets certain requirements that the lender deems acceptable. If you plan on taking out a contractor line of credit, you’ll need to consider the following:

Company Revenue: Lenders like to see businesses that are profitable and large enough to justify the credit line. The contractor’s revenue is the presumed method of payback so your annual revenue should justify the size of the line of credit you’re requesting.

Company History: Banks will look at how long your company has been in business for confidence in longevity. Companies younger than 2 years old are higher risk and less likely to get approved without putting up significant collateral.

Credit Analysis Ratios: It’s important to understand the different credit ratios that banks might investigate when doing their credit analysis. These scores are used to assess how well-equipped a business will be to pay back a debt.

- The core groups of credit analysis ratios (each of which include a handful of different types) are:

- Profitability Ratios – Measures the company’s ability to generate profit relative to assets, revenue, and shareholder equity.

For example: A Return on Assets ratio (ROA = Net Income / Average Assets) shows how much money the company returns in net profit for every dollar of assets the company invests in. - Leverage Ratios – Measures debt levels against cash flow, income, and other accounts on the balance sheet.

For example: A Debt to Equity ratio (D/E = Debts + Fixed Payments/Shareholder Equity) shows how much leverage creditors and shareholders each have over the company’s assets. - Coverage Ratios – Measures how well the company’s cash, income and assets can cover their interest and debt.

For Example: A Debt Service Coverage ratio (DSCR = Earnings Before Interest, Tax, Depreciation, Amortization / Interest + Principal) shows how well equipped the company is to repay interest and principal of existing debts with their operating income. - Liquidity Ratios – Measures the company’s ability to readily turn assets into cash.

For example: A Current ratio (CR = Current Assets/Current Liabilities) shows how easily a company can liquidate its assets to meet short-term financial obligations.

- Profitability Ratios – Measures the company’s ability to generate profit relative to assets, revenue, and shareholder equity.

Guarantees: A guarantee is an official agreement in which a guarantor, usually either a business or individual, takes responsibility for managing debt repayment in case the contractor defaults. Guarantees usually come in the form of a personal guarantee or corporate guarantee.

Personal Guarantees: Some banks will ask for a personal guarantee, especially with smaller businesses. In this case, they may ask you to put up some of your personal assets as collateral to ensure repayment.

Personal Credit History: Part of a financial institution’s due diligence is to assess the credit worthiness of all parties involved, including the contractor’s personal credit history.

Covenants: Covenants apply to both loans and lines of credit, and describe the terms and conditions of your line. Consult a legal entity to help navigate these agreements before signing.

How to Effectively Use Your Contractor Line of Credit

If a contractor is not diligent about their spending and repayment habits, they may find themselves maxing their credit limit or missing payments. That’s why incorporating your line of credit into your budget requires careful strategy and care.

There are some industry best practices to help you efficiently manage your line of credit:

-

- Borrow only when there is a clear path to revenue: It’s best to be selective when drawing from your line of credit. Just because you are approved for a maximum credit amount does not mean you need to use it. Take steps to guarantee you will be paid for the work and will be able to promptly pay it off. (For example: You may want to reconsider putting expenses on your line of credit if you have a risky Pay if Paid clause in your contract, meaning you assumed the most risk.)

- Separate personal and professional finances: Most small to mid-sized businesses have a tendency to lose track of their spending habits and may use funds from their business line of credit to accommodate personal project costs. Oftentimes, this leads to exceeded credit limits which can damage your personal and professional financial standing.

- Build a strong history of timely repayment: Payment history is a significant factor that banks look at when evaluating your credit-worthiness, which is why it makes up over 35% of your credit score. Make your payments on time, and whenever possible, pay off your balance in full to help build strong payment history.

A Better Alternative to a Contractor Line Of Credit

Contractor lines of credit come with their share of risks and benefits, which contractors can assess based on their financial position. However, alternative contractor financing solutions exist to supplement lines of credit and bank loans.

Billd is an innovative alternative financing option for contractors that gives contractors longer terms to pay for their materials. With Billd covering material costs, contractors can reserve their lines of credit for smaller, non-material costs. At Billd, our team has first-hand experience in the construction industry, and we understand that managing cash flow can be difficult. Our payment solution is designed to help contractors purchase materials swiftly and comfortably, without the added risk.