Cash flow strain is a pervasive problem that nearly all contractors share, no matter how large or financially savvy they are. Thanks to erratic payment cycles in the construction industry, it’s not a question of “if” your business will experience tight cash flow, but “when.” Although this can create an obstacle to business growth for many contractors, there are tried and true methods to help contractors overcome it. The best way to counter cash flow challenges is to leverage contractor financing on your projects. Contractor financing helps you secure materials and assets when you need them. This allows you to take on more projects and grow your business with confidence and ease.

Financing options for contractors include:

Table of Contents

What Are My Financing Options as a Contractor?

Line of Credit

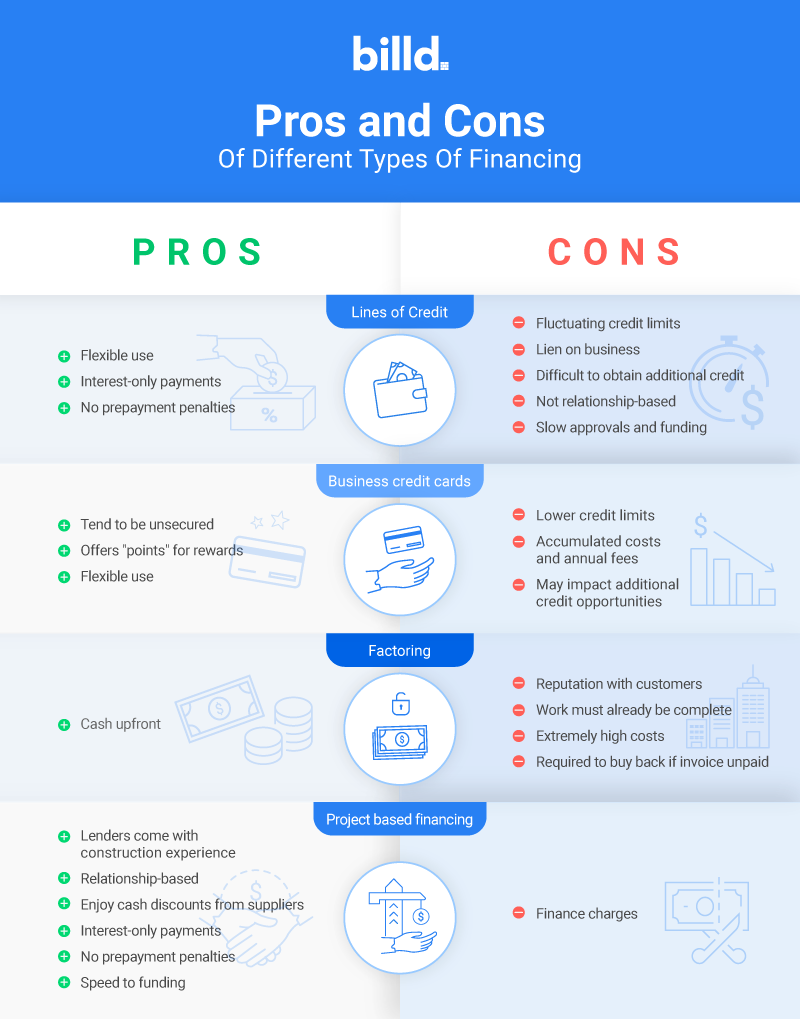

A line of credit is a borrowing limit that can be tapped at any time, for as much or as little as required, from lenders such as banks or credit unions. This type of flexible financing is there when you need a little extra cushion, and you only repay interest on the outstanding balance.

Generally viewed as a contractor’s lifeline, contractor lines of credit are almost always secured and not something you would want to max out. As is the case with credit cards, it’s best to safeguard your line of credit and always keep it as a buffer for emergency expenses. For this reason, carrying a large balance on your line is not ideal.

Here are a few other things to consider with contractor lines of credit:

- Credit limits: Credit limits on your line of credit may fluctuate. Should you miss a payment, it’s common to see your line of credit cut in half or dropped to your present balance. This can cause you to max out more quickly than you anticipated. Because contractors often struggle with cash flow and may not always have the cash needed to make a payment, this is important to keep in mind.

- Difficulty obtaining additional credit: To secure the line of credit, the bank will often put a blanket lien on your business. This could make it more difficult for you to obtain additional credit, because the first lien holder (the bank) has to give permission for you to take on more debt. However, not all financing options put a lien on the business, in which case permission from the bank would not be needed.

- Payment terms: Read your contract closely. Determine whether there are fees associated, what the repayment schedule is like, and whether there are late payment penalties.

- Risks: Consider the legal implications of taking on a line of credit, especially large amounts secured by business collateral. If you default on payments, this could result in loss of assets, bankruptcy or foreclosure of the business.

- Not relationship-based: Because lines of credit are issued by banks, you can generally expect them to be inflexible and impersonal. Because they operate with the strict guidelines and procedures of major corporations, they lack a personal touch. Banks don’t tend to be understanding of your circumstances, and generally don’t forge a strong personal relationship with the businesses they’re lending to.

Business Credit Card vs. Line of Credit

Much like a line of credit, a contractor credit card will have a predetermined credit limit you can spend. However, credit cards are almost always unsecured, whereas lines of credit are typically secured on the business. Credit cards usually come with lower credit limits than lines of credit, making them less useful to contractors, whose purchases could eat up tens of thousands of dollars very quickly. Although contractor credit cards typically offer points, this benefit is easily negated by the fees and costs associated with credit cards. You end up paying a substantial amount of money for small perks like a “free trip” and other inconsequential “bonuses.”

Factoring

With construction contractor factoring, a company will take on your accounts receivable from a customer for a fee, providing you with a percentage of the unpaid invoice in cash. Invoice factoring provides an important service that can potentially save a business in cash flow distress. It works well for business owners that need money quickly, have reliable customers that have a history of paying invoices predictably, and can afford the fees that come with selling invoices to a third party.

Here are a few things to consider with factoring:

- The practices behind invoice factoring can be unfavorable, especially for contractors:

- They push for faster payment to improve their margins

- They remove contractors from the payment chain and seek repayment from the GC

- Their aggressive business practices can harm relationships with the GC

- High rates and surprise fees are common

Project Based Contractor Financing

Project-based contractor financing is optimal for those who want to partner with finance experts who focus specifically on the construction industry, understand your business inside and out, and provide strategic guidance and support for the success of your business. Construction financing partners typically specialize in lending to specific aspects of a project — materials, labor or equipment — and, unlike traditional financial institutions, they lend with your project in mind versus solely your credit score.

Materials are a popular option for project based contractor financing because of when materials are needed relative to the time a contractor is paid for their work. Furthermore, suppliers generally require either payment upfront or on terms, but even terms are not long enough to eliminate the gap between when a contractor needs to pay for materials in full versus when they’ll be paid for the job. Here’s how material purchase financing it works:

- Your business partners with a construction financing partner such as Billd, who will get to know your business and examine your project.

- The partner provides upfront cash, paid directly to your supplier, so you receive the materials you need, when you need them.

- You repay the cost of the materials over time, versus in one lump sum.

More than just a borrower-lender relationship, this option is a valuable partnership with long-term benefits for your construction business.

There are a lot of options for financing your construction business. Additionally, there are a number of different types of financial institutions that you can work with. Be sure to find a lender that understands your business inside and out, works with contractors consistently, and is well versed in the challenges of construction payment cycles. This understanding will be critical if and when projects are delayed and loans become due. After all, you’re leveraging financing to provide flexibility to your business, so try to find a partner that’s equally as flexible.

Improving Construction Cash Flow

Cash flow problems will likely affect all contractors in the construction industry, big or small, at some point, even causing some to go out of business without running out of work. Positive cash flow is simply having more cash flow into the business each month versus going out the door each month, while a negative cash flow is just the opposite. However, cash flow is not an exact representative of revenue and expenses. For example, you submitted a $500,000 pay app of which you have $400,000 in costs you have already spent. Submitting the pay app represents $500,000 in revenue on your income statement, but since cash has not been received, cash flow is equal to negative $400,000, the amount of cash that you’ve already spent.

For contractors, negative cash flow is caused by a number of issues, such as fixed payroll costs, slow-paying projects, and the need for buying assets or materials up front. With contractor financing, you can improve your cash flow by spreading out costs over time versus making large, immediate payments.

Parts of Your Construction Business That You Can Finance

Construction businesses typically finance materials, labor or equipment. Consider how each option will help achieve your business goals before choosing which area to finance.

Labor

Along with materials, labor is a large cost for contractors, and includes salaries and wages, benefits and taxes for your crews and management. Having these estimated expenses covered prior to on-site work will allow you to successfully complete projects without running short of funds for payroll. Labor is typically paid for through cash flow, putting a big strain on the business, especially when you’re dealing with slow paying clients. Taking out an SBA loan or line of credit from a bank or credit union could be an option for financing labor.

Materials

Materials are historically financed through either credit cards or supplier terms. Credit cards are an easy way to buy materials now and pay for them later, but are usually associated with smaller credit limits, limiting the size of purchase you can make. Supplier terms on the other hand, allow you to get materials now and pay your supplier back in 30-60 days. However, construction payment cycles make this challenging, and the bill is frequently due before payment has been received for the job. Billd is a good option here, which provides up to 120-day terms with your material suppliers.

Equipment

Equipment is another common expense to finance. Construction equipment is expensive and purchasing it outright could cause a major strain on cash flow. Therefore, financing equipment is a great way to go. When financing equipment, loans are typically amortized and each month a portion of interest and principal is paid back. Once the loan is fully paid off, any liens on the equipment are removed. Equipment leasing is another option if you prefer to lease as opposed to own. You may be more inclined to lease if new models of equipment are frequently released, you do not want to put a lot of money down on a purchase, you are looking for lower monthly payments, or if you need consistent upgrades on the equipment.

Consider Your Contractor Financing Options Carefully

At the end of the day, it’s important to feel good about your financing decision. Contractor financing should be a supplement to your business and provide you with the flexibility to do business on your terms. Additionally, it’s important to find the right financial partners, ideally those that understand construction and can be flexible when inevitable challenges arise.

About Billd

At Billd, our team has a deep understanding of the construction industry, and we know that cash-flow can be a major hurdle to business success. That’s why we created a project-based financing solution to help contractors purchase materials upfront, tackle that big new job with confidence and then enjoy a little breathing room with our 120-day repayment terms. Discover how Billd can help you do business on your own terms.