The inaugural Billd National Subcontractor Market Report provides statistics on general outlooks toward business growth & financing in the construction industry.

This report was founded upon a survey conducted in March 2021, which queried contractors on their business growth goals, capital sources, and how supplier terms influence their financing decisions. Their responses yielded the following insights:

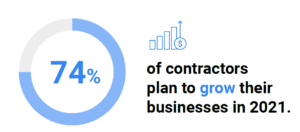

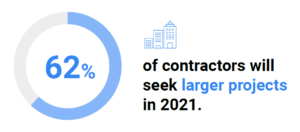

- 74% of Contractors remain eager to grow their business despite mounting economic challenges. A resounding entrepreneurial spirit is clear.

- Contractors are undercapitalized, and working with lackluster credit & financing options. 44% of Contractors believe they can depend on cash flow to grow their business.

- 46% of Contractors struggle with cash flow thanks in large part to long industry payment cycles. This reveals a contradiction in their approach to financing growth.

- About half of Contractors are generally satisfied with their suppliers terms (which average 30 days), despite the fact that most contractors pay for materials before being paid for their work.

We’ll explore the implications, as well as unique insights found in the data collected, and offer an industry veteran’s perspective on how to chart a path forward for subcontractors.

Table of Contents

About the Survey Respondents

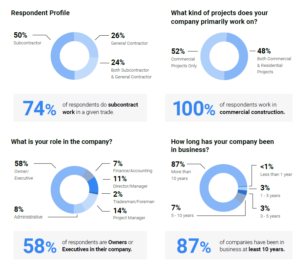

The survey was completed by 572 commercial construction professionals across a variety of trades, capturing information on their business growth goals, relationships with suppliers as well as the state of supplier terms, and preferred financing options. Respondents completed the survey in March 2021.

Macroeconomic Conditions

Skilled Labor

Industry commentators have long since remarked that there is a growing shortage of skilled labor, due in part to the stigmatization of trade schools and the veneration of university degrees. 74% of respondents said that the availability of skilled workers would impact their business in 2021.

New Regulations

Contractors are cognizant of how new regulations could potentially affect their business this year, with 64% saying that they would impact their business in 2021.

Access to Capital

Access to capital proved critical to driving growth, with 39% of contractors indicating that it would impact their business this year.

Business Growth & Trends

Contractors’ Collective Desire to Grow their Business

Entrepreneurial Spirit Remains High

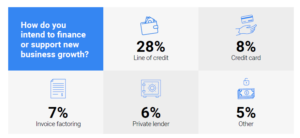

To finance these goals, the remaining 44% of subcontractors believed they would use cash on hand.

However, data and general consensus on commercial construction payment cycles suggests that this is not entirely viable. While some growth may be possible with existing cash flow, it may not be as large or sustainable as contractors hope. Eating into working capital to finance growth, in the absence of additional financing, has inherent limitations.

The Challenge of Using Cash Flow to Support Business Growth

The timing of your progress payments — a subcontractor’s cash flow during a project — hinges on how well you put the Schedule of Values together. And, as any contractor knows all too well, when you’re running on tight margins and even tighter timelines, cash flow is everything.

When you submit a payment application, the owner or architect will use the Schedule of Values to review the work performed and either dispute the application or release payment.

Every contractor is familiar with the erratic and largely unpredictable nature of commercial construction payment cycles. Project payment is contingent upon multiple factors, with the potential for considerable delays in the payment chain. Cash flow alone is far too unpredictable to consistently and comfortably pay on time for labor or materials, let alone to reliably finance the sizable expenses that come with scaling a business.

Despite a collective insistence to rely on available cash flow, 46% of respondents admit that cash flow is a notable challenge for their business.

Credit Options

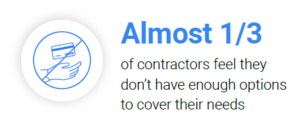

When asked if their credit options supported the growth and needs of your business…

Despite challenges with cash flow, 71% believe their business credit options support the needs of their business.

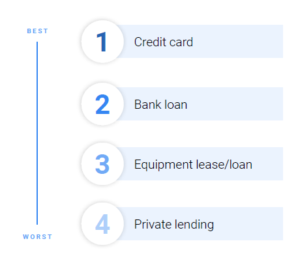

To gain a better understanding of contractors disposition toward various credit options, the survey had contractors’ rank how positively or negatively they viewed each option.

Ranked from best to worst, the results were as follows:

Neutrality overtook contractors’ responses toward every option, showing they don’t appear to show strong favoritism toward any given credit option. A “preference” for credit cards wins out only by a slim margin. Interestingly, there’s an inverse relationship between price and preference. The higher the cost, the more favorable contractors seem to be. This is likely due to the simplicity and ease of use of the product.

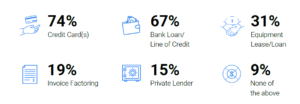

What types of options does your construction business currently have available?

(Select all that apply)

The Use of Credit Lines

The report shows an overreliance on lines of credit for everyday business expenses. 38% of contractors reported that they rely on credit for everyday business expenses, such as equipment, materials and payroll. This is problematic, contradicting the best practice of keeping credit lines reserved for emergencies. Payroll, equipment and material purchases are sizable expenses that quickly eat into a contractor’s credit line. In the event of an emergency, they may not have the credit available to overcome it.

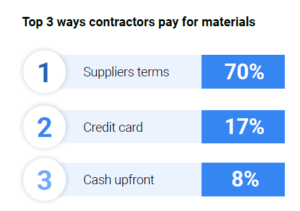

Supplier Terms

When asked to select their most common method for purchasing materials, contractors showed considerable reliance on supplier terms. 89% have terms with suppliers. 70% of contractors polled preferred supplier terms over credit cards, cash or bank loans. However, data gathered in Rabbet’s annual Construction Payment Report shows that those terms are not long enough to support construction payment cycles.

When asked to select their most common method for purchasing materials, contractors showed considerable reliance on supplier terms. 89% have terms with suppliers. 70% of contractors polled preferred supplier terms over credit cards, cash or bank loans. However, data gathered in Rabbet’s annual Construction Payment Report shows that those terms are not long enough to support construction payment cycles.

89% of contractors have terms with their suppliers.

49% of contractors do not believe their terms are sufficient.

A Reliance on Supplier Terms

Contractors appear complacent towards the state of supplier terms, with only 36% reporting dissatisfaction with them. Observers can easily make sense of contractors’ preference for terms. When compared to other options, like lines of credit and credit cards, terms will not eat into a contractor’s emergency credit reserves. Additionally, contractors view terms as having no cost associated with them, although that’s not entirely true. The cost of financing is apparent when suppliers offer cash discounts or options like 2% off when paying within 10 days (2/10 Net 30).

65% believe their suppliers are flexible with terms and support their business.

The Shortcomings of Supplier Terms

18% of contractors have been denied purchasing more materials from a supplier they already work with because they did not have adequate credit limit

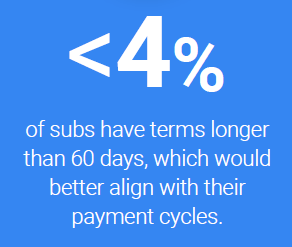

Despite their overwhelming popularity as a payment method for materials, supplier terms do not offer contractors the flexibility they need to grow into larger or more complex commercial projects. Supplier terms also cost contractors money and minimize negotiating power. They bring underlying costs, not immediately visible to the contractor. Suppliers tend to offer cash discounts, or options like 2/10 Net 30. These built in discounts for paying in cash are essentially fees when utilizing the terms. According to Rabbet, an average of 71% of contractors polled in the last three years wait longer than 30 days for payment. Therefore, the length of terms in relation to project payment timelines are their ultimate shortcoming.

Despite their overwhelming popularity as a payment method for materials, supplier terms do not offer contractors the flexibility they need to grow into larger or more complex commercial projects. Supplier terms also cost contractors money and minimize negotiating power. They bring underlying costs, not immediately visible to the contractor. Suppliers tend to offer cash discounts, or options like 2/10 Net 30. These built in discounts for paying in cash are essentially fees when utilizing the terms. According to Rabbet, an average of 71% of contractors polled in the last three years wait longer than 30 days for payment. Therefore, the length of terms in relation to project payment timelines are their ultimate shortcoming.

An Industry Veteran’s Perspective

Supply chain finance in the commercial construction industry is terribly broken and it has been for decades. Subcontractors are sandwiched between poor payment cycles and a lack of credit options where they sit at the bottom of the payment stream. This report offers a compelling sentiment that despite the headwinds of access to capital and slow paying projects, subcontractors are optimistic about their growth.

But it’s not just about growth. It’s also about survival. Flexible financing options have quickly become integral to conducting business in this turbulent market. We’ve all watched as material availability has become scarce and prices have skyrocketed.

Without a landscape of supportive, flexible financing options, it will become increasingly difficult to do business at all in our industry. Subcontractors are business owners for whom access to capital isn’t “nice to have,” it’s a necessity. That’s what makes this report, the problems it explores, and the solutions the industry will react with, all the more timely.

The lack of subcontractor credit options presents a ripe opportunity for new companies to charge into the industry to offer credit options tailor-made to the industry needs. In doing so, construction finance startups like Billd are widening access to capital, and enabling more subcontractors to grow their business.