As an experienced subcontracting executive, you’ve already learned how to overcome problems that hold most subcontracting businesses back—slow pay, labor challenges, project and material delays, and razor-thin margins. You’ve built strong relationships and a resilient business that can weather the unpredictable nature of the industry. And you’ve done it largely by leaning on your cash and bank line of credit.

That’s impressive.

But here’s the harsh reality from a CFO’s perspective: The strategy and mindset that got you to this point won’t take you where you want to go.

Why? Because you can’t grow your business with cash alone.

In this article, we’ll share a construction CFO’s advice for why a cash-only strategy limits your business’ growth potential.

Table of Contents

Cash is a Reward, Not a Growth Vehicle

Cash should serve a larger purpose in your business than just covering expenses. When you reinvest all of your cash into other people’s projects by fronting the cost for material and labor, you’re not building your company; you’re subsidizing someone else’s.

“Cash is your reward for a job well done,” said Luke Boyenger, CEO of Cruzumi CFO & Advisory, during a recent Meetup. “You get to use that cash to reward yourself for running a successful business. But if all you’re doing is taking the cash that you’ve earned by doing great work and using it to fund other people’s projects for free, that doesn’t make sense.”

Use Your Bank LOC for Your Own Expenses

Growth requires capital—more capital than you’re using or likely have access to right now. Too many subcontractors max out their bank line of credit to fund project costs. According to Boyenger, that’s backwards. Your LOC should give your business breathing room during periods of low cash inflow by allowing you to cover payroll and other expenses. But if you’re using it to float job costs, you’re burning a tool that’s meant to protect you.

“The whole point of getting the line of credit in the first place was to have the working capital for your business, not somebody else’s project,” Boyenger said. “If you’ve tapped out your own line of credit to fund projects, and now you need money to fund your business, it’s not available.”

Build a Capital Stack for Growth

As your business scales, your working capital has to mature with it. The mindset, “I’ll just use my profits to grow,” has a ceiling, and most subcontractors don’t proactively secure more capital. According to the 2025 National Subcontractor Market Report, only 41% of subcontractors making more than $15M in annual revenue seek more capital before they need it.

Boyenger said, “As your business grows, you need access to additional capital to expand your capital stack. You’re probably expanding your line of credit because you need to increase bonding capacity or you need access to more capital because the business is larger and you need a bigger buffer. But you also need to look for other forms of capital that fit what you do as a business.”

Evaluating your growth goals requires you to look at capital holistically and be honest about what you need to support your revenue goals. You’ll need to expand your LOC, tap into additional options like material financing, and get proactive—not reactive—with capital planning.

“If all you’re using is cash and line of credit, you’re always going to be out of cash because you’re always going to operate at the absolute capacity of your cash and line of credit.”

It’s tempting to think you’ll save enough profit to meet your growth goals. Unfortunately, construction rarely works that way. Growth happens faster than cash comes in, and the opportunities that allow you to hit your growth goals are often unexpected. If you’re only relying on retained profits, you’ll always be two steps behind the opportunities in front of you.

Leveraging Debt is a Business Investment

Some subcontractors want to avoid using debt, and their concerns are valid. But not all debt is bad. When used strategically, outside capital is an investment in your future profit. If borrowing a few hundred thousand dollars helps you generate millions in new revenue, that’s a smart use of outside capital.

Other subcontractors avoid using financing because of the additional cost. However, by using it proactively and accounting for the cost of it in your bids, you don’t have to absorb the cost of using capital to keep projects running smoothly. Additionally, due to the size and nature of expenses in construction, it’s often not realistic to be able to cover all the upfront costs out of your own pocket, especially during a period of growth.

“Use your line of credit to run your business. Use your cash to reward yourself for a job well done. Use other forms of capital to cover the cost of projects for other people. It’s all about the right tool for the right job.”

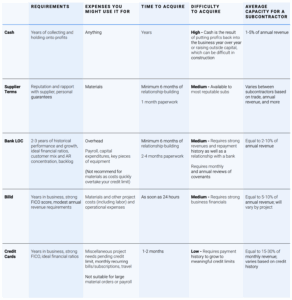

Some other forms of working capital that may be in a subcontractor’s capital stack (as well as their capacity and how they may be used) are included below:

Due to its finite nature, growth doesn’t happen with cash alone. “It’s about building the capital stack to support the business that you’re trying to build—not just relying on cash and your line of credit like you’ve always done.”

To evaluate whether your capital strategy is ready to support your growth goals, download our free whitepaper on building a robust capital strategy.