Billd has released the second annual National Subcontractor Market Report. Last year’s report honed in on the financial reality of subcontractors. Despite having just emerged from a pandemic, last year’s market conditions were perceptibly calmer — even if financial options were (and always have been) tight.

This year told a different story. A volatile market threw construction businesses for a loop. Longtime murmurs of labor shortages became a reality that the industry could no longer ignore. Nevertheless, subcontractors navigated the year with resilience.

Conducted in February 2022, the second annual report investigates how the market changed, the impact of these changes on subcontractors, and the attitude they’ve adopted in dealing with them.

The report focused on the following key areas:

- The impact of macroeconomic conditions

- Business growth trends and attitudes among subcontractors

- How subcontractors’ financial picture affects their ability to do business

Table of Contents

Who Took the Survey?

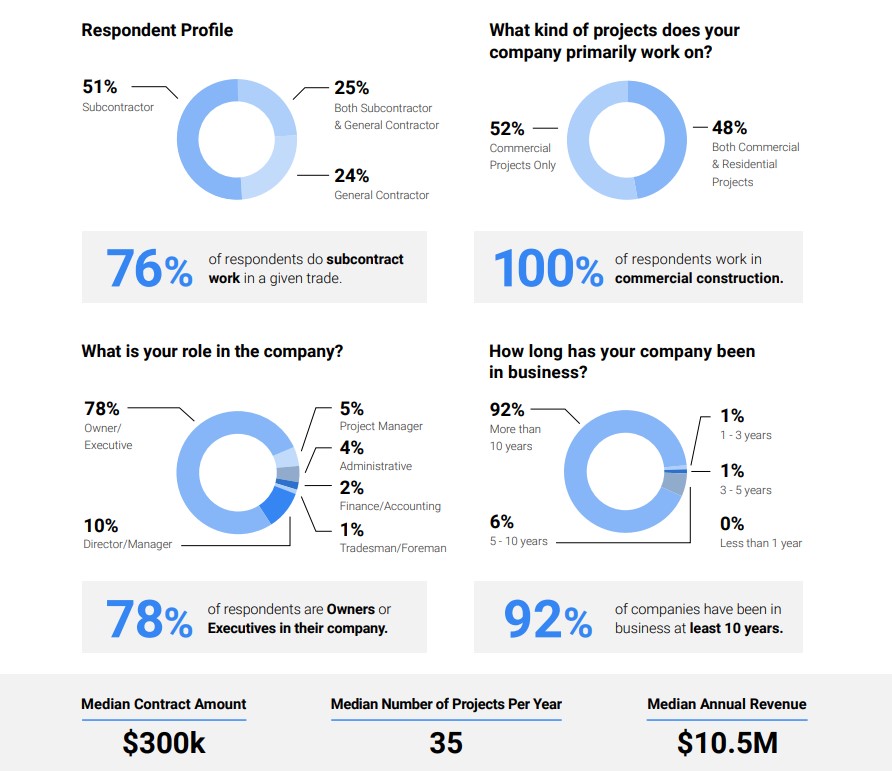

767 construction professionals in a variety of trades took the survey from which Billd built this report. These respondents completed the survey in February 2022.

What Were The Top Macroeconomic Conditions That Affected Construction Businesses?

A staggering 57% of contractors saw a decrease in profitability in 2021, and Billd probed into the macroeconomic conditions that contributed to that outcome.

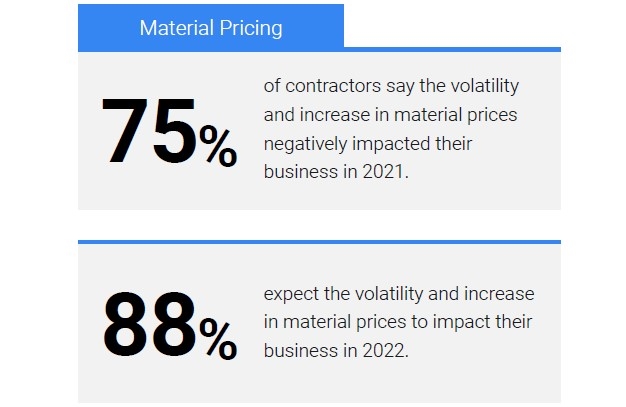

Material Price Volatility

Although volatile material prices aren’t an entirely new phenomenon, they stood out in 2021 as a starker challenge to subcontractors.

- 75% of contractors say the volatility and increase in material prices negatively impacted their business in 2021.

- 88% expect the volatility and increase to impact their business in 2022.

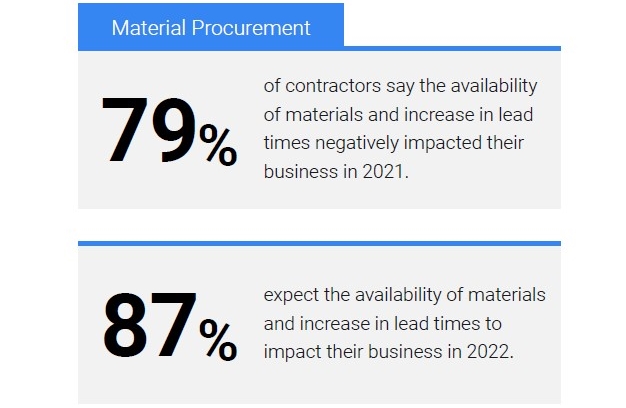

- 79% of subcontractors say material availability and long lead times negatively impacted their business in 2021.

- 87% expect the availability of materials and increase in lead times to impact their business in 2022.

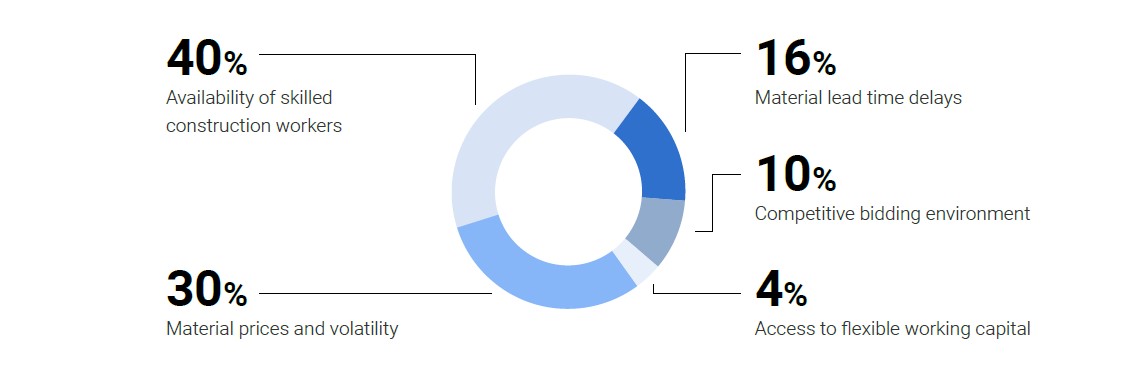

Ongoing Labor Shortages

Labor remains the biggest concern for commercial subcontractors, with 40% of subcontractors responding that the availability of skilled workers was the single greatest challenge they were dealing with in the course of doing business.

- 40% Availability of skilled construction workers

- 30% Material prices and volatility

- 16% Material lead time delays

- 10% Competitive bidding environment

- 4% Access to flexible working capital

What Are Subcontractors’ Business Growth Goals in 2022?

The survey was constructed to glean subcontractors’ disposition toward business progression, and how it may grow or recede in various climates. Declines, some subtle, some more overt, were observed this year, but weren’t entirely surprising given the more volatile conditions of the market.

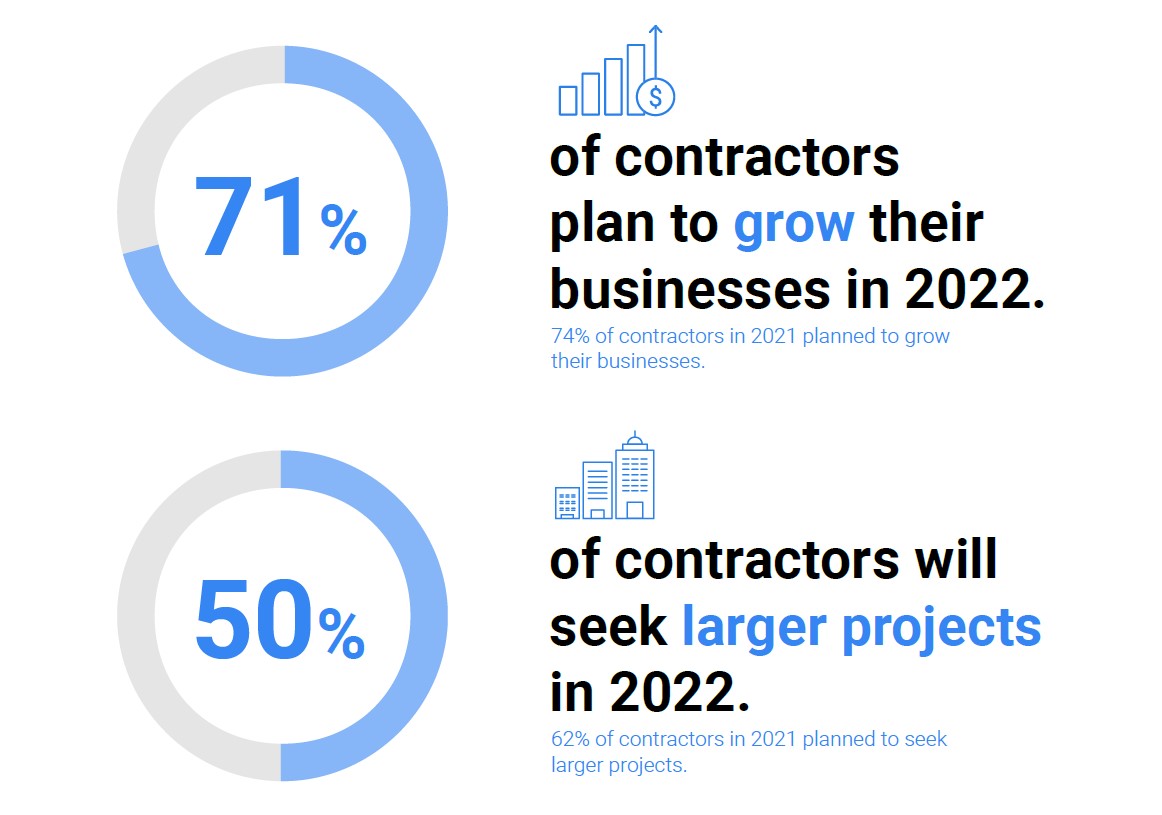

- 71% of contractors plan to grow their businesses in 2022, compared to 74% in 2021.

- 50% of contractors will seek larger projects in 2022, compared to 62% in 2021.

That said, with two-thirds of the industry continuing to set their sights on business growth, there’s no refuting the entrepreneurial spirit of subcontractors, as the report explores in greater depth. However, the question of how they will finance this growth, remains murky.

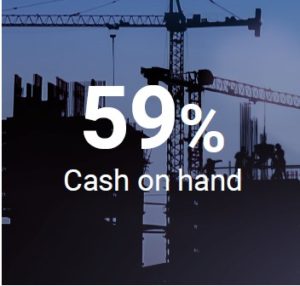

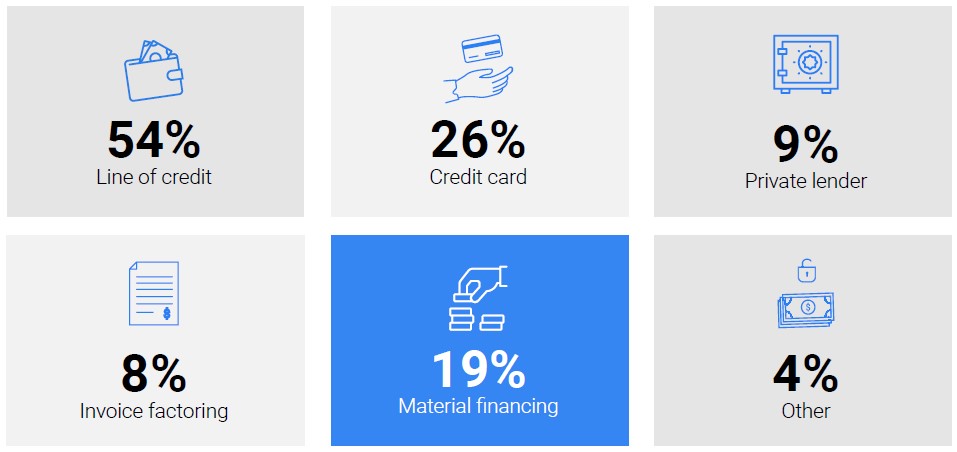

When polled as to how they would finance their growth, the majority of respondents reported they would use cash on hand — which is arguably better kept in reserve. The growing reliance on cash flow overlapped with a greater utilization of material financing.

- Cash on hand 59%

- Bank line of credit 54%

- Credit card 26%

- Material Financing 19%

- Private lender 9%

- Invoice factoring 8%

- Other 4%

Why Relying on Cash Flow to Grow Doesn’t Work

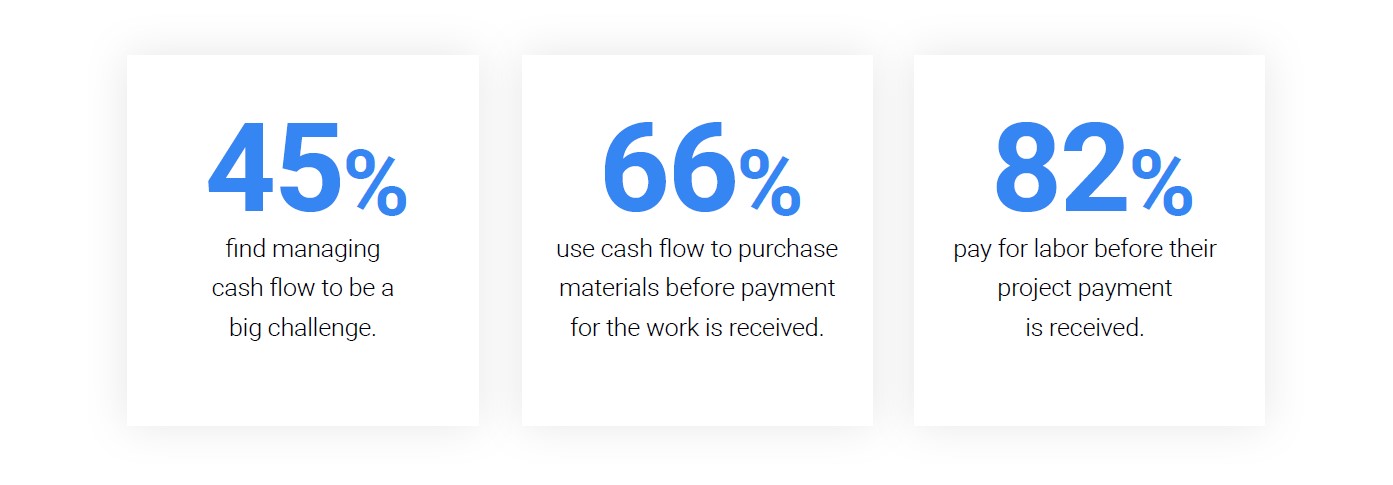

Although subcontractors intend to use cash to grow, this strategy is inherently risky, as demonstrated in the followup questions that the report revealed.

- 45% Find managing cash flow to be a big challenge.

- 66% Use cash flow to purchase materials before their project payment is received.

- 82% Pay for labor before their project payment is received.

- 80% of contractors wish they were paid faster.

In an industry where subcontractors are often paid last, have to wait an average of 83 days for payment, and front the cost of materials and labor — using cash to fund growth and take on larger projects means they are putting extreme pressure on their cash reserves. Or worse, depleting them. The nuances of this challenge are explored in the full report.

How The Payment Landscape Makes Cash Flow Dependence Hard

Speaking to the point above, subcontractors reported they would be willing to accept a pay cut if it meant getting paid faster — an incredible illustration of just how deep the challenge of slow-pay really is.

- 78% of contractors wait more than 30 days to receive payment from a GC after they submit their pay applications.

- 97% of contractors receive payment with a paper check from their GC or property owner.

- 68% of contractors pay their suppliers through paper checks fairly often.

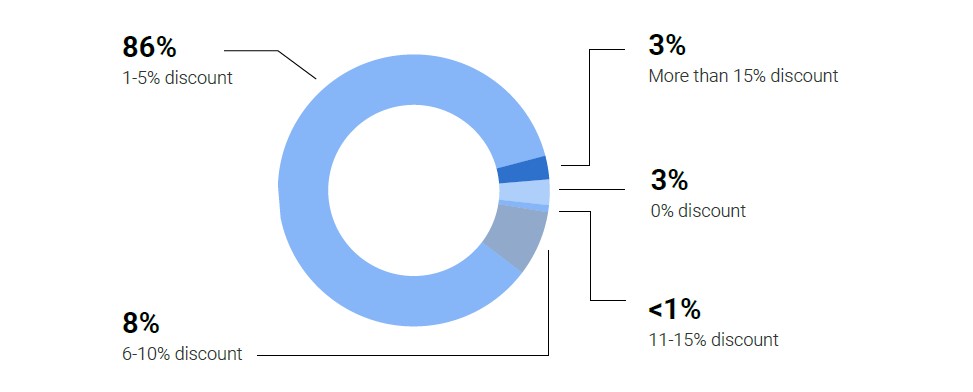

- What is the maximum discount you would accept for guaranteeing payment within 3 days of an approved pay application?

-

-

- 0% discount: 3%

- 1-5% discount: 86%

- 6-10% discount: 8%

- 11-15% discount: <1%

- More than 15% discount: 3%

-

- 86% of contractors willing to take a discount would pay up to 5% of their pay app.

How Do Subcontractors Feel about Supplier Terms in 2022?

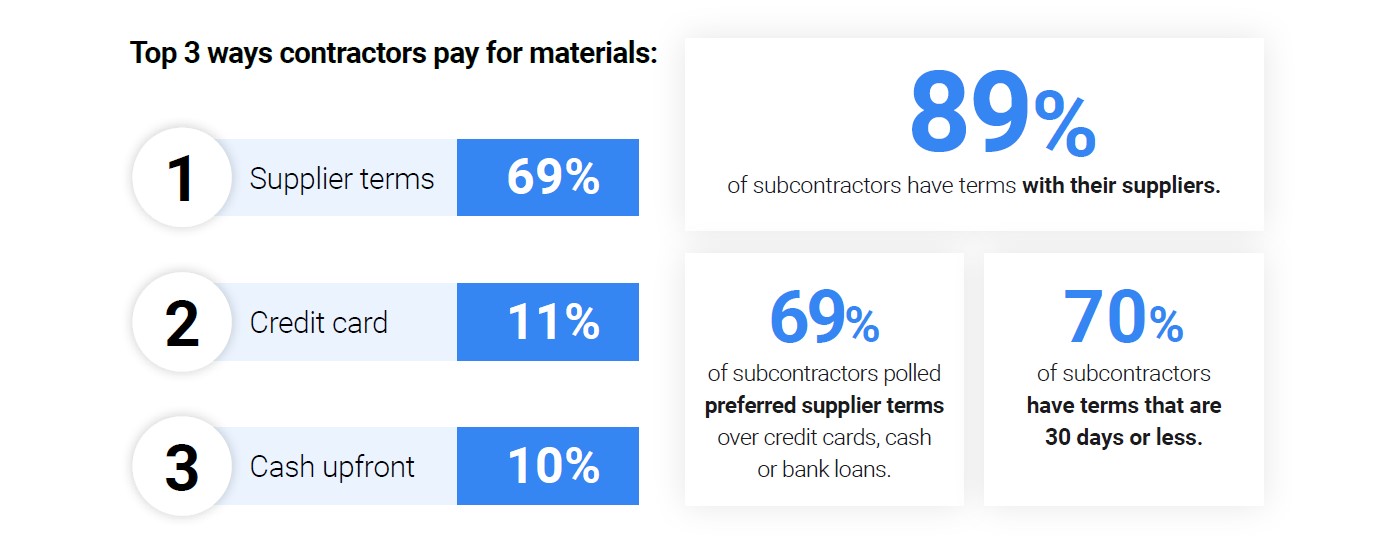

Supplier terms were the overwhelming favorite for purchasing materials last year, and they held onto their place. However, there is a hidden cost associated with supplier terms. The report explores this in greater detail.

- 89% of subcontractors have terms with suppliers.

- 69% of subcontractors polled preferred supplier terms over credit cards, cash or bank loans.

- 70% of subcontractors have terms that are 30 days or less.

Top 3 ways contractors pay for materials:

- Suppliers terms 69%

- Credit card 11%

- Cash upfront 10%

What are the most common terms your suppliers typically offer your business?

- 10 days 3%

- 30 days 67%

- 45 days 14%

- 60 days 12%

- More than 60 days 4%

Subcontractors appeared to be more satisfied with their suppliers’ terms last year, and there was a slight dip in satisfaction this year.

- 56% do not believe their terms are sufficient compared with 49% last year.

- 60% believe their suppliers are flexible with terms and support their business compared with 65% last year.

- 31% of contractors reported that their supplier terms were adjusted in 2021 due to increasing prices or longer lead times, squarely reflecting the impact of market volatility.

How Do Subcontractors Feel About Innovation in the Industry?

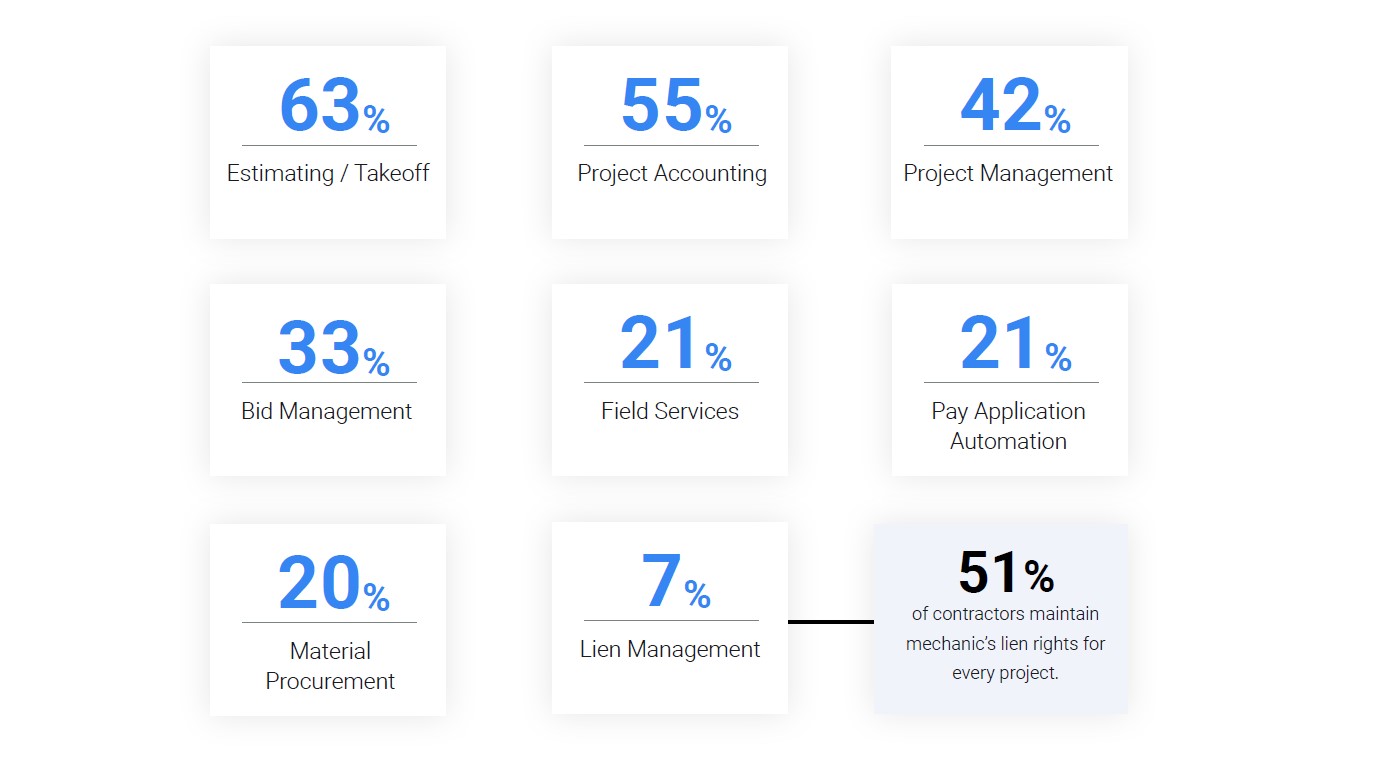

New tools are emerging to serve the industry in many different areas, and Billd wanted to gauge the extent to which they’re being utilized. The report breaks down the implications of how frequently each software type is being leveraged.

72% of contractors are open to trying new technologies that will make their business more efficient.

What construction technologies and software does your company use? (check all that apply)

- 63% Estimating / Takeoff

- 55% Project Accounting

- 42% Project Management

- 33% Bid Management

- 21% Pay Application Automation

- 21% Field Services

- 20% Material Procurement

- 7% Lien Management

- 51% of contractors maintain mechanic’s lien rights for every project.

Trends & Takeaways

In the full report, Billd CEO and industry veteran Chris Doyle offers his in-depth perspective on its findings. With bloated costs and a competitive bidding landscape, subcontractors still have to meet rising demand. But that doesn’t mean they aren’t up for the challenge. Doyle dives into the source of this demand and how subcontractors can prepare themselves to meet it, and why it still ultimately pays to be in construction.

The report, yet again, made it difficult to ignore the fact that subcontractors get the short end of the stick in the construction industry. The solution comes back down to the fact that subcontractors need advocates. They need financiers and suppliers and GCs who truly align their success with the subcontractors’. They need partners who will help them weather a volatile market and unpredictable price changes. The old industry model has to evolve, and Doyle’s conclusion in the report explores how.

Billd is the first, true champion of the subcontractor. Tackling one of the biggest pain points in the construction industry, Billd offers commercial subcontractors financing terms that finally align with their payment cycles. Supply chain finance has long been broken in construction, leaving subcontractors footing the bill for materials and labor far before they’re paid for their work. Through Billd’s financing and payment solutions, subcontractors can take control of their cash flow to take on larger projects, grow their business, and ultimately cement their legacies.