It’s said that you have to spend money to make money, and in construction, that’s true. To take on larger projects and grow your construction business, you need to be able to pay for labor, materials, and overhead — many times, all upfront. And that’s exactly the challenge: Companies don’t always have the cash available to pay for those things until they’re paid for the project, often 85 days (on average) after they’ve started the work.

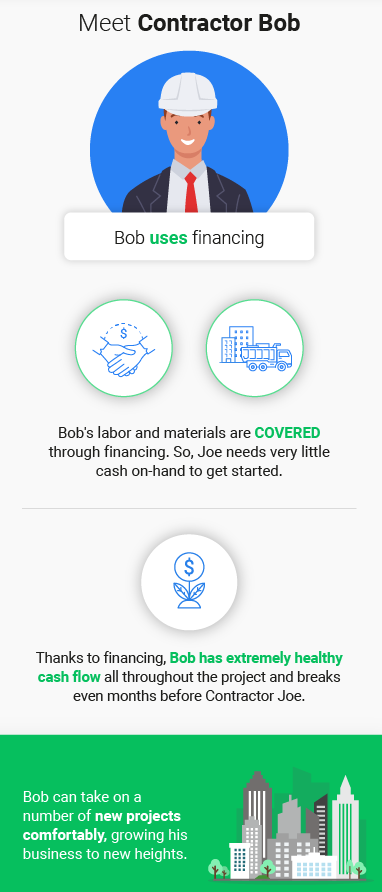

That’s why contractor financing is essential for construction firms. For many companies, financing is key to taking on more and larger projects, and ultimately, growing their business. Specifically, contractor financing allows companies to purchase materials and labor upfront, and pay for them later, after they’ve received payment for work they’ve performed. Through this method of debt, construction companies can do more with less, and ultimately, exponentially grow their construction business.

Improved Cash Flow

In the construction industry, there are a number of companies and individuals involved in every project, from the project owner to general contractors to subcontractors. If any one participant experiences a delayed payment, the consequences typically extend to the other parties. According to Levelset, it takes an average of 83 days for a contractor to get paid from the date they start work.

Those delays and cash flow issues can limit a contractor’s ability to take on additional projects.

Construction financing, however, can bridge that gap and allow contractors to take on projects they may otherwise have to turn down, or worse, accept and have trouble getting started.

To illustrate the impact financing can make, consider the following example: Let’s say you are awarded a project, but first need to understand how much upfront cash you need to get started.

Project Contract Value: $500,000

Project length: 4 months

Materials: 40% ($200,000)

Labor: 30% ($150,000)

Overhead: 15% ($75,000)

Target Profit: 15%

Example Without Financing:

Example Without Financing:

While your company likely won’t start getting paid for the project for 85 days (industry average) from when you start the work, you will need to begin paying for material, labor, and overhead costs either immediately or within 30 days of starting work.

That means during month 1 and 2, you’ll need enough cash to cover your expenses. In the third month, you’ll receive the first portion of your payment (for the work you did in the first month), but even that won’t be enough to produce a positive cash flow.

Total Costs in Month 1: $50,000 in Material + $37,500 in Labor + $18,750 in Overhead = $106,250

Total Costs in Month 2: $50,000 in Material + $37,500 in Labor + $18,750 in Overhead = $106,250

Cash from Sales in Months 1 and 2: $0

Total Cash Spent = $212,500

Total Costs in Month 3: $50,000 in Material + $37,500 in Labor + $18,750 in Overhead = $106,250

Cash from Sales in Month 3: $125,000

Cash Balance After Month 3: -$212,500 + $125,000 – $106,250 = -$193,750

In this example, without contractor financing, you will need $212,500 in upfront cash to take on the new project. In addition, you won’t achieve a positive cash flow until month six, so your company will need to be prepared to survive negative cash flow for five whole months.

Ultimately, you will profit $75,000, but you’ll take on some serious business risk along the way. Your company will need to be prepared to survive negative cash flow for five whole months.

Example With Material & Labor Financing:

If you take advantage of material and labor financing, the example takes a much different turn. With contractor financing, specifically using material purchase financing and a contractor line of credit from a bank to cover labor, you can delay material and labor costs for up to 120 days. While you will still be responsible for your overhead costs, and you will need to pay a small finance charge (usually about 2.5 percent per month), it’s clear that you can achieve a significant business advantage. Compare how this plays out using contractor financing on this project:

Total Costs in Month 1: $18,750 in Overhead + $2,188 Finance Charges [2.5% x ($50,000 Materials + $37,500 Labor)] = $20,938

Total Costs in Month 2: $18,750 in Overhead + $3,500 Finance Charges = $23,126

Cash from Sales in Month 1 and 2: $0

Total Cash Spent = $44,064

Total Costs in Month 3: $18,750 in Overhead + $6,564 Finance Charges = $25,314

Cash from Sales in Month 3: $125,000

Cash Balance After Month 3: -$44,064 + $125,000 – $25,314 = $55,622

In this example, with labor and material financing, you only need $44,064 in cash to start the project, compared to $212,500 without financing. In addition, you will begin experiencing a positive cash flow in your third month of the project, compared to month six when you don’t use financing.

To be clear, there is cost to financing. In this example, you will end up profiting $55,000 with financing, compared to $75,000 without financing. However, many companies find that the benefits far outweigh the cost. When you need less cash to take on a project, you have an increased ability to take on larger and more projects. And ultimately, that can be a key to helping you grow your construction business.

In evaluating the decision to use financing or not, it can be helpful to look at the cash-on-cash return. Typically, this metric is used to evaluate real estate investments to understand how much cash was generated from the cash invested. However, it can be applied to this situation to demonstrate the return you made on the investment relative to the amount of cash you had to spend upfront to finance the project.

Using financing: $55,000 Profit / $44,000 Initial Expenses = 125% return

Without financing: $75,000 Profit / $212,500 Initial Expenses = 35% return

This calculation means you gained a 125% return on your $44,000 investment with financing versus a 35% return on your $212,500 investment without it.

That’s a significant difference and highlights the amplification of contractor financing.

Increased Ability to Take On (and Successfully Complete) Larger Projects

The examples above show the decrease in cash needed to take on projects with and without financing. Contractor financing gives you the opportunity to take on more projects at once. Rather than taking on one $500,000 project for $212,500, like in the example above, you could take on 4 of those projects for basically the same amount of cash by using material and labor financing.

Example: In our example above, you needed $212,500 to take on 1 project worth $500,000 with financing. You only needed $44,000 with financing. If you had $212,500, you can take on FOUR more of those exact projects (44,000 x 4 = $176,000) at the same time.

Leveraging Contractor Financing In Your Business

With contractor financing, you can free up the cash you need to purchase the necessary resources for your projects, including:

- Materials: Larger projects typically require more materials. With material purchase financing, you get the materials now to start the project, but delay paying for them until you get paid.

- New or more equipment: A new piece of equipment may enable you to complete a larger job at a faster rate — but only if you have the capital to purchase that piece of equipment. With contractor financing, you can make large purchases like this without having to use your available cash.

- Additional labor: Larger projects may require additional labor or workers with specialized skills. Financing can give you the flexibility you need to hire the people who can help you successfully complete the project. Labor financing will usually come in the form of a contractor line of credit from a bank.

Financing shouldn’t be seen as a liability, but rather, as an opportunity to grow your construction business. With contractor financing, you can confidently take on bigger — and often, more — projects, without worrying about needing vast amounts of cash upfront.

To calculate the benefits for yourself, check out Billd’s cash flow for contractors tool. With just a few clicks, see how much cash you need to get started on a project, with project-based financing versus without it.

At Billd, we help contractors like you grow your construction business. Through our new payment solution for buying materials, suppliers receive upfront payments, while contractors enjoy 120 days to pay, so you can avoid cash flow problems and amplify your business’s growth. Contact us to learn more.